Property Management Fees – What is typical for Victoria?

In this weeks blog, Lisa Parker, Melbourne Buyers Agent, discusses property management fees and what to expect when you purchase an investment property in Melbourne.

The information shared in this article is based on reviewing many fee schedules for our clients each and every year. It is an overall picture designed to illustrate typical fee schedules. Not all fee schedules you receive will be identical as there are many different ways a property manager may elect to propose their fees. This article will give you a good guide as a starting place.

Property Management in Victoria is made up of several different fees

There are a number of fees applicable in Melbourne. Some or all of them may be included in a fee proposal given to you buy a property manager. The types of fees are;

- Leasing fee – covers all the work relating to finding a tenant for the property.

- Advertising

- Lease Renewal Fee

- Statement Fee

- Postage

- Annual Statement – itemises income and expenses and makes it easy for you to complete your tax return

- VCAT attendance – represents you at VCAT when an issue with the tenant arises

- Renovation management

- Lease negotiation

- Routine/annual inspection

- Management fee

The other fees you will see when you first list your property for rent are:

- Advertising

- Photography

Uncommon fees may also include:

- Arranging repairs, maintenance, or improvements

- Reference checking

- Phone calls made on your behalf

- Paying bills on your behalf

How much & When do you pay your property management fees

Below is a simple graph outlining the fees, how much to expect for each fee and how often the fees are paid.

Common mistakes investors make when considering property management fees

Many investors focus on one fee and one fee only. That fee is the “management fee”. The management fee is typically expressed as a percentage of the weekly rent. Often investors shop around looking purely at this fee and try to hire a property manager offering the lowest percentage. This is usually a big, but common mistake.

When weighing up the management costs it is important to look at the whole picture, not just the weekly management percentage.

I recommend clients compare all the fees, the frequency of the fee and how likely it would likely apply. Then you can easily work out the total amount you will pay. This gives you a more accurate picture and allows you to compare the TOTAL cost for the service, rather than making the mistake of focusing only on the property management fee.

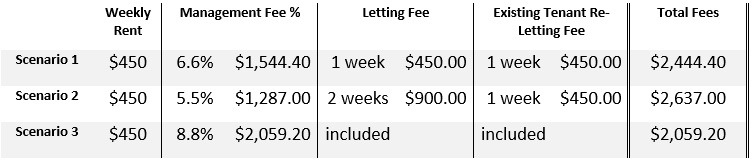

Here is an example of three different rental fee schedules to illustrate the point about not shopping just for the cheapest management fee. For simplicity I have only included basic fees that are very common.

ARE FEES NEGOTIABLE

Some fees can easily (and fairly) be negotiated with the property manager without compromising on service or experience level. A property manager will often want to protect the value of their management fee (the percentage of rental received) because the value of the business is often linked to this percentage. They may instead offer to remove or offer a discount on the other fees instead.

Remember to assess all fee proposals in their entirety before making your decision.

IN CONCLUSION

Many investors have limited visibility of what a property manager does for them behind the scenes. It is therefor easy to under value the service and think they are “just collecting the rent”, which leads to investors hiring cheap, rather than experienced.

I personally prefer to hire well and pay a higher fee in exchange for better processes and more experienced manager. It doesn’t require any skill to offer the cheapest service, but it does take a lot of skill and experience to protect your asset and make investing a smooth process for you.

If you would like to speak with us about assisting you with your investment purchase, please fill out the form below and we will be in touch.

Recent Comments